Okay, for this episode, I am going to sound like a broken record. If you’re tired of listening to me say it, you can turn this off and never listen again, haha. I really do say this on every single one of these, and I mean it: this is a Lendr product update episode, and it’s my favorite kind of episode. I love going over the new stuff we’ve been cooking and working on and it has been everything from AI-generated loan descriptions and faster load times to smarter automations and better loan servicing. The list is pretty long, which is kind of crazy because it hasn’t been that long since the last update—maybe a month. Yet it’s exciting to watch features roll out, requests get handled, updates and fixes land, and, yes, sometimes things break and then get un-broken. That’s the rhythm. We’ve got a lot of good things today, so without further ado, let’s jump in.

… it’s exciting to watch features roll out, requests get handled, updates and fixes land…

What I love about these updates is that you can literally see the platform getting sturdier and smarter in real time. Features come from conversations with users, from our own experience, and from all the little papercuts we notice while using Lendr every single day. Some of the changes are small and quiet; others are big swings. Together they add up to a smoother, clearer experience. That’s the thread running through everything here, and it’s why these episodes are my favorite kind to record.

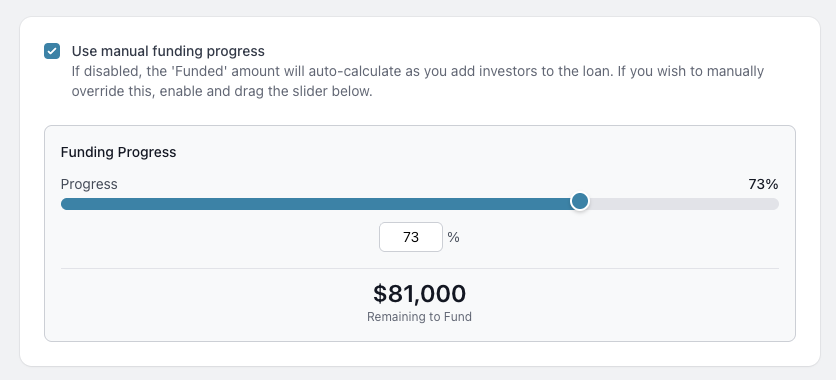

Loan Listing Opportunities: Manual Funded Slider

First up, the Loan Listing Opportunities tab—the place where you market deals and basically say, “Hey, we’ve got a deal we’re looking to fund. Do you want in?” We added a manual funded slider so you can set the progress yourself. In the past, if you had a $100,000 loan and you added investors—say $50,000 from John and $50,000 from Steve—the progress bar would show 100% funded. That sounds right until you’ve actually closed with your own cash and want to raise capital to replace it. You didn’t want the listing to scream “no more money,” because you were still actively raising.

Now you can check a box and drag a slider to show whatever makes sense for the moment. If you want to say “20% funded—still seeking $80,000,” you can. If you want to create a bit of scarcity, go ahead. Or if you want to be 100% transparent and say, “This is funded, but we’re still looking for money to replace our capital,” that’s also fine. The point is control. You can manipulate the slider to match your real fundraising plan, not just the bookkeeping state of who was added first.

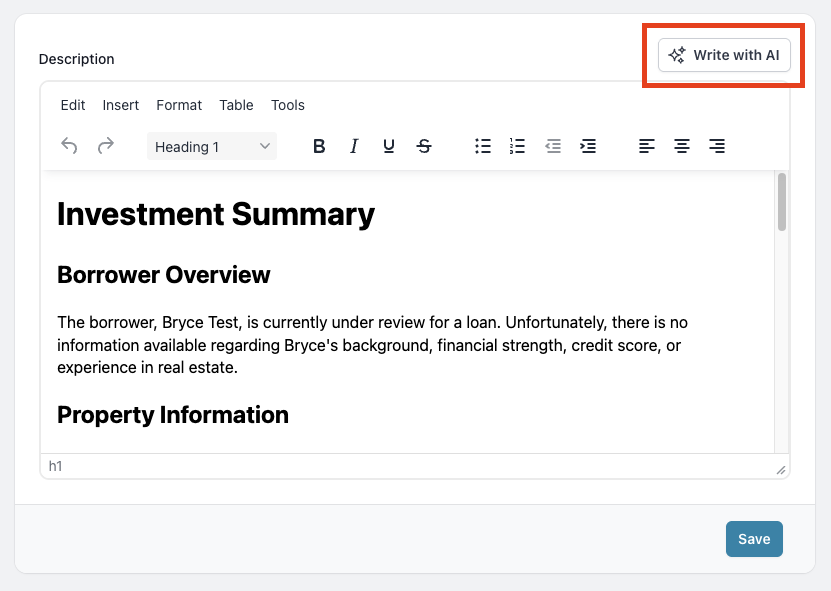

Loan Listing Opportunities: AI-Generated Descriptions

Alongside that, we made some serious improvements to AI descriptions on listings. At the bottom of the edit listing screen, there’s a place for an opportunity description—things like the borrower’s credit score, the LTV, and the projected returns and rates. Before, you had to write it manually every time. Now there’s a “Write with AI” button. You click, wait about 10–15 seconds, and the system generates a description pulled straight from the loan file.

What it’s doing behind the scenes is exactly what you’d do manually, only faster. It looks at the borrower’s credit, takes the risk profile into account, and then references the title commitment and other key data points. Then it builds a full-on risk analysis description you can use as-is or lightly edit. You don’t have to type everything from scratch. You wait those few seconds, make a couple of tweaks, and you’re good. It’s fast, the writing is solid, and it’s based on the actual data already in the file.

It looks at the borrower’s credit, takes the risk profile into account, and then references the title commitment and other key data points.

Loan Servicing Enhancements: Current Balance & Late Payment Columns

Next, the Loan Servicing tab. We added two new columns that should have been there sooner: Current Balance and Late Payment. You used to see the original loan amount, which is fine for historical context, but not the real-time principal after reductions. Now, if you started at $100,000 and posted a $20,000 principal reduction, the grid will show $80,000 current balance at a glance. No jumping into another view to do the math or confirm someone’s notes.

On the late side, if you’ve got a six-month term—say payments from January through June—and the borrower missed March, you’ll see a late indicator right in the servicing view. That status was always trackable somewhere else, yet having it visible next to everything else speeds up your scan. You can sort, scan, and act without toggling around. It sounds simple, but these are the little changes that make servicing feel like a single, coherent screen instead of a map of destinations you have to visit one by one.

Performance: Faster Loan Loading and Clearer State

Now for a big one that doesn’t look big until you feel it—loading speed. A loan page is not just a street address and a loan number. It’s a huge data graph: borrower info, borrower credit, borrower address, borrower entities, borrower documents; then all of that again for the co-borrower if there is one. Add in the amortization schedule, the payment breakdown, the interest earnings, and every calculation that flows from those. It’s a lot.

Previously, assembling all that could take around 300 milliseconds per loan. That might sound fast, but multiply it when the system is loading many loans or lots of underlying pieces at once. Suddenly you’re waiting seven seconds, maybe more, and you’re just staring at a blank white screen. We reworked the data ingestion, re-ordered some calculations, and generally made it more efficient. We also added a loading screen so you can actually see the state and know the system is moving. What used to feel like seven seconds now lands around 2–2.5 seconds. It’s a meaningful difference when you’re in the flow and clicking from one thing to another.

What used to feel like seven seconds now lands around 2–2.5 seconds.

Scope of Work: CSV Import

For Scope of Work, there’s a quality-of-life upgrade that borrowers will love. If a borrower already has an Excel or CSV file with their line items—“$5,000 flooring,” “$8,000 windows,” and so on—they no longer need to add each one line by line. They can drag and drop the CSV, and the Scope of Work will auto-populate from that spreadsheet. It’s faster, less tedious, and less error-prone than retyping the same list you’ve already priced out.

You can still edit after import, of course. If you need to adjust a number or correct a label, you just do it in place. Yet when a borrower arrives with a full scope already structured, this import spares everyone a lot of clicking and checking. It’s the kind of small feature that ends up saving time on almost every construction deal.

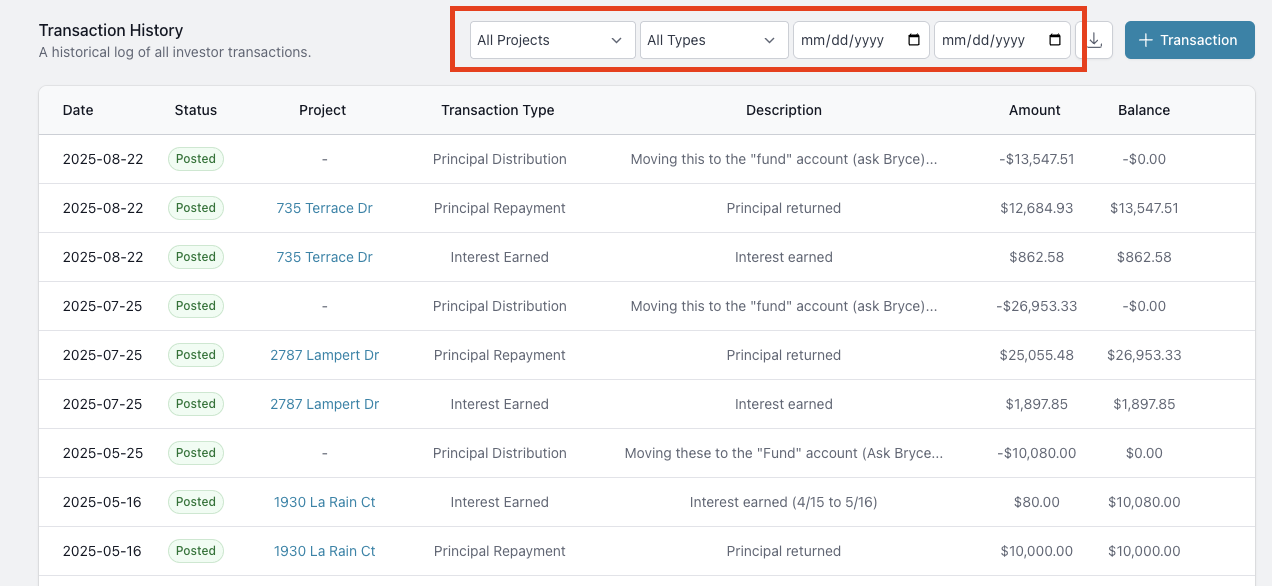

Investor Ledger: Transaction Filtering

Inside the Investor Ledger, we added filters that should make hunting down a specific set of transactions a lot easier. Before, the ledger was basically one long page. Now you can filter by date, transaction type, amount, and property. If you want to pull up every instance of interest earned for a particular investor, you can. If you want only the items tied to 123 Main Street, you can isolate those as well.

Nothing fundamentally changed about the accounting or the numbers; the changes are in the view. Working investors usually means lots of transactions that look similar until you isolate context. With filtering, you aren’t scrolling and scanning as much. You just tell the ledger what you want to see and let it collapse everything else. It’s the same data, only now it’s in the shape you actually need.

You just tell the ledger what you want to see and let it collapse everything else.

Pending Interest: Expanded Detail and Time Filters

The Pending Interest screen also got more granular. It still tells you what you owe your investors, what you’ve paid them, and what they’ve earned. Now you can expand to see the details—the exact amounts tied to each period—and filter the timeframe you want. That includes “since the most recent distribution,” “2025,” “2024,” or “lifetime.” If you’re doing a current payout and want to verify the delta since last time, you can. If you’re reconciling an entire year, that’s available too.

This used to feel static. It told you the “what,” but you had to go elsewhere to dig deeper. The change is that the period view and the detail are now on the same page. You click, expand, and adjust the timeframe, then you see everything associated with that slice. When you’re closing out a month or prepping a distribution, it’s just smoother.

Document Generator: Word Export Compatibility Fixed

There was a nagging issue with Word exports from the document generator. Most people export PDF by default, but sometimes you need Word so you can tweak a number or adjust a line without rebuilding a template. Every so often those Word files wouldn’t open properly in Pages on a Mac or would look strange in Google Docs. Some files had odd characters. Some threw errors. It was annoying, and it stuck around too long because other things kept bumping it in priority.

That’s fixed. Now, if your payoff statement is 95% of the way there, you can export as Word, change the specific number you want to change, and you’re done. No template surgery. No rebuilding the entire doc for a single adjusted figure. It’s a small repair that frees you to use the generator the way you intended in the first place.

No template surgery. No rebuilding the entire doc for a single adjusted figure. It’s a small repair that frees you to use the generator the way you intended in the first place.

Email Automations: From Your Company Name

Email automations now appear to come from your lending company. Technically the sending address is still noreply@joinlender.com when you drill all the way down, but the visible From name is Holbrook Capital or whatever your configured entity is. That means when you email a title company or a borrower, they see your brand first.

It’s a simple shift that removes confusion. People used to ask, “What is Lendr?” when the sender didn’t match the business they knew. Today, the automated communications look like they came from you because that’s how you want them to look. It’s cleaner and more professional for the end recipient, and it keeps your communications consistent across the board.

Custom Fields in Servicing: Columns You Can See

Custom fields in the loan application—like instrument number and recording date on the deed of trust—have always been useful for templating and recordkeeping. Now they can also appear as columns in Loan Servicing. That means you can glance at the servicing table and spot those values without opening a side panel or exporting anything.

Many lenders use custom fields in slightly different ways, which is the point. Having them visible in servicing makes the data feel present, not tucked away. You can still feed those fields into docs and templates as before. The difference is that you can view and sort by the custom values in the place you spend most of your time.

… you can glance at the servicing table and spot those values without opening a side panel or exporting anything.

Amortized Loans: Overhaul and Ongoing Refinement

We’ve done a massive overhaul to amortized loans. A lot of private lenders don’t focus on amortization-heavy products—myself included—so the feature set had gaps. You could technically do amortized structures, but parts of the math were a little off. It didn’t always behave the way you expected when you ran the numbers forward and backward.

We worked closely with a user who does amortized loans all the time—thank you, Josh—and pushed through a lot of fixes and refinements. The result is significantly better support. There might still be a gremlin or two hiding in an edge case, and we’ll keep working those out as we see them. For most workflows, though, amortized loans feel solid now.

Document Template Tags in Automations: Unified Variables

Inside your document templates, you’ve always had those bracketed variables—tags you copy and paste to pull information from the loan file. In Automations, we had variables too, but they were different. That never made much sense in hindsight. You had to learn two sets and remember what worked where.

We unified them. The same document tags now work in automations. If you hover over the Documents section and open the Template Tag Reference, the tags you see there are the tags you can use everywhere. The old automation-only tags are gone. Your pool of options effectively jumped from something like a hundred to hundreds, if not thousands, since you can reach into anything the doc system can reach into. It’s all one language now.

The same document tags now work in automations.

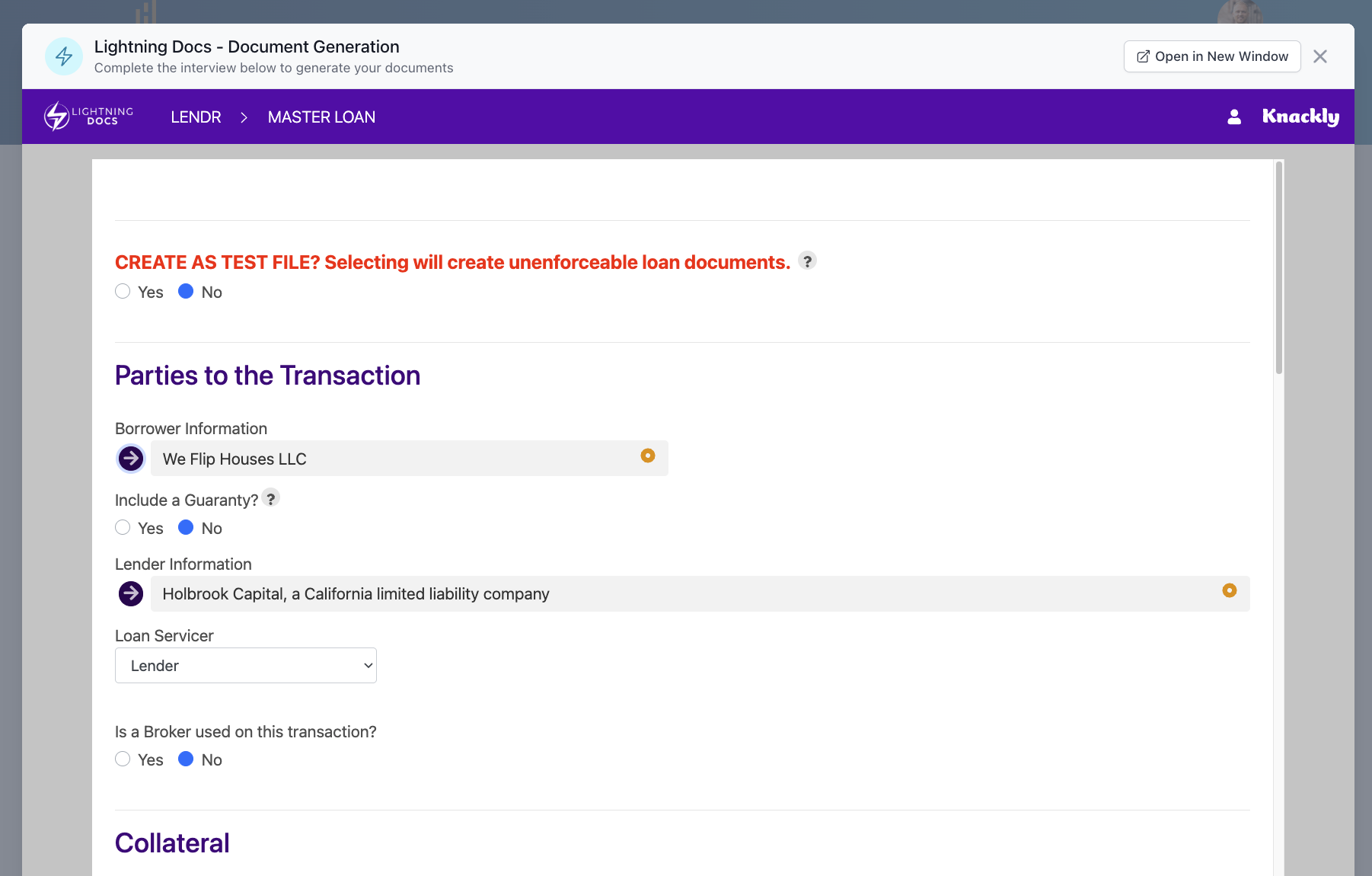

Lightning Docs Integration: Available on All Plans

We now integrate with Jirasi’s Lightning Docs, and it’s available on any plan. You enable it under Settings → Integrations and connect your Lightning Docs account. Once that’s done, you can send the borrower, the guarantor, the LLC, the incorporation date, the terms, the rates—all the pieces Lightning Docs needs—directly from your loan file.

If you’ve ever copied and pasted that stuff by hand, you know why this matters. It’s faster, less error-prone, and more consistent. You simply push the data over and let the integration do what integrations do. No juggling between windows. No double entry. Just a clean handoff.

Draw Requests: Export to Zip

Draw requests can now be exported to a zip. That export includes photos, receipts, line items, and all the numbers that go with them. If you aren’t keeping the loan on your own balance sheet and you’re table funding or handing the draw to a third party, that third party often wants the material in a package they recognize.

With this export, you can accept the draw in Lendr and then hand the funder a single, tidy file. If they’re used to a certain review process—Kiavi, Rock Capital, whoever—this makes it easy. You don’t have to grant access or explain your internal view. The file contains everything they need to sign off or ask their own follow-ups.

… you can accept the draw in Lendr and then hand the funder a single, tidy file.

Borrower Onboarding: Bio/Blurb Toggle

During borrower onboarding, we used to ask for a quick bio or blurb—“We’ve been flipping for twenty years; here’s our average profit; here are some projects.” Not everyone wanted to fill that out. A lot of borrowers asked, “Why is this there?” So we switched the default. The bio field is disabled by default now.

If you prefer having that context, you can turn it back on in Settings. It hasn’t disappeared from the system; it’s just not required for every borrower. The idea is to keep onboarding smooth and avoid making people type when it doesn’t add value for your specific workflow.

Reporting: Applications by Month + Dashboard Widget

There’s a new Loan Applications by Month report with views for the last 12, 24, or 36 months. It’s useful if you want to see whether your pipeline was heavier eighteen months ago or lighter three months ago, and how that compares to where you are now. Sometimes you want to blame the market; sometimes you realize you need to push harder.

We also added a Loan Volume widget to the dashboard. It’s not as detailed as the full report, yet those bars are a great pulse check. I use it as a nudge. If the chart shows a dip, I know it’s time to ramp the pipeline and get more deals moving. The combination of a quick dashboard glance and a detailed report is a good rhythm.

The combination of a quick dashboard glance and a detailed report is a good rhythm.

Automations: New Triggers for Charges, Payments, and Tags

Automations got new triggers. You can fire sequences when a charge is created, when a payment changes state, or when a tag is applied. The classic example is NSF. Lendr already auto-adds an NSF fee when a payment comes back non-sufficient funds. Now you can watch for that charge and automatically email the borrower to explain what happened and what will happen next.

You can trigger when a payment is created, paid, unpaid, or failed. You can also trigger based on a specific tag you add to a loan. People get creative with tags, and with these hooks the automations become flexible in a way that makes sense for your internal process. It’s fun to see what people build when we give them a few more switches to flip.

Term Sheets: Generate Inside the Loan File

You can now generate term sheets from inside the loan file. Until now, you had to go to the Pipeline, click the three dots, and open the term sheet flow from there. That still works, but sometimes your brain is already deep in 123 Main Street, and it’s distracting to jump out.

Now you can preview and send the term sheet directly from whatever tab you’re in. If you’re reviewing details and you decide, “Okay, let’s send the term sheet right now,” you can do it without leaving the context you were working in. It’s a small but very natural shift.

… you can preview and send the term sheet directly from whatever tab you’re in.

Mortgage Statements: Auto-Email and Optional Portal Upload

Mortgage statements are now automatically emailed. You can also choose to upload them to the borrower’s portal/profile, and that’s a simple on/off choice. Previously, the statement existed and you got told it existed, but the delivery step was still manual.

If you’re trying to make monthly communications standard and predictable, this helps. Borrowers get the statement when they expect it. Your team doesn’t have to remember one more recurring task. You can keep the upload toggle off if you prefer to email only, or turn it on if you want statements handy inside the portal.

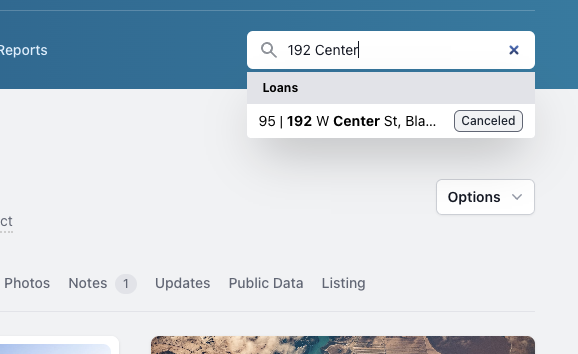

Smarter Search: Directional Addresses

Search has been updated to handle directional addresses. If you typed “123 Main Street,” you wouldn’t necessarily see “123 South Main Street,” “123 NE Main Street,” or “123 West Main Street” because the directional broke the string match. That wasn’t helpful when the property is the same but the address was input with a directional in one place and not the other.

We taught search to skip those directional bits when it needs to. Now you’ll get all the Main Street variants together. This is the kind of tweak that ends a common “Did I mistype that?” moment and gets you to the loan or property you wanted without making you second-guess how it was entered.

This is the kind of tweak that ends a common “Did I mistype that?” moment

Investor Swaps: Visual Flow and Roll-Up

Mid-loan investor swaps are powerful, but they can get complicated. You might start with a $100,000 investor position and then split it—$50,000 to Jason and $50,000 to Steve. Later, you might split those again—$25,000 pieces going in different directions. After a couple of rounds, it can be tough to remember who swapped with whom and where the money flowed.

We added a visual flow you can expand and contract. It rolls up to the top-level amount so you can always see how the pieces relate back to $100,000. Nothing changes about how swaps work; it’s an audit trail that makes sense to the eye. If you need to explain the lineage to someone else—or to yourself six months from now—you can do it quickly.

Extension Fees: Minimums for Small Loans

You can now set a minimum extension fee. This is especially useful on small loans. If you’ve got an $80,000 loan and you charge 1 point for the extension, the math would normally be $800. If you prefer to set the minimum at $1,000 so the effort is worth it, you can do that in the system.

We’ve had minimums for origination fees for a while, and this brings parity to extension fees. If you’re doing smaller balances, the minimums make sure extensions remain aligned with the time and overhead it takes to handle them properly. Turn it on, set your number, and it just works.

We’ve had minimums for origination fees for a while, and this brings parity to extension fees.

Documents UI: Blue Dot “Viewed” Indicator

There’s a small new blue dot in the Documents table. It sits on the file-type icon and indicates whether you’ve viewed a document. Click the file, and the blue dot disappears. It’s essentially read/unread for uploaded docs.

If you’re solo, you might shrug. If you’ve got three, four, or five processors moving pieces around in the same file, you’ll see the value immediately. Someone on the team uploads a PDF; you’ll know whether you’ve looked at it yet. You won’t be guessing if that appraisal is new or the same one you saw yesterday. It’s a tiny indicator that keeps a team in sync.

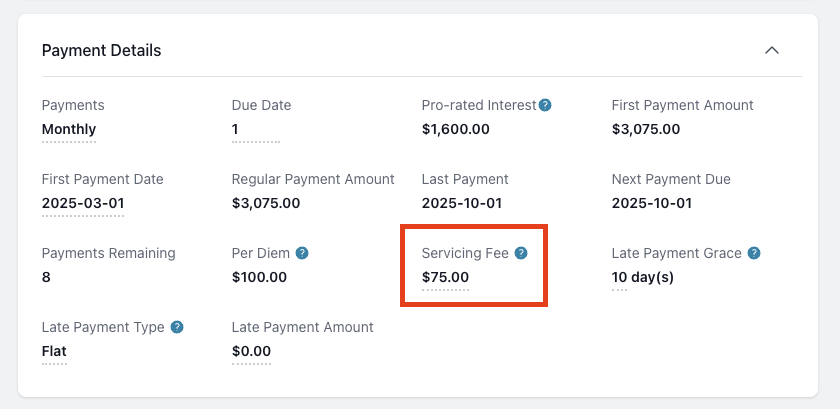

Recurring Servicing Fee: Added to the Scheduled Payment

We added a recurring servicing fee that actually increases the monthly payment. Before, you could add a recurring $35 ACH or servicing charge, but it sat as a charge on the side. It didn’t change the scheduled installment, and it might be collected later or at payoff. That was fine technically, but it didn’t reflect the real cash flow you wanted every month.

Now, if the payment is $1,000, adding a $35 recurring servicing fee makes the payment $1,035. That’s cleaner. It’s also paving the way for escrow-like handling down the road—things like taxes and insurance—because the system now has a clear, built-in way to add structured amounts to every payment automatically.

… the system now has a clear, built-in way to add structured amounts to every payment automatically.

Trust Accounting: Ledger, Journal Entries, and Zero-Out

Finally, we spent a lot of time on trust accounting. Construction draws have always made sense inside Lendr, and prepaid interest on origination is common too. Think of it like this: you originate a $100,000 loan at 12%, and the monthly payments come out to $1,000. If you collect $6,000 in prepaid interest, that’s six months sitting in a kind of piggy bank to cover those payments.

The piece we improved is how the Trust Ledger aligns to the bank account one-to-one. As you issue draws or mark payments as paid from reserves/prepaid, the ledger now records line items and journal entries so you can trace every movement. If the ledger shows $100,000 and the bank shows $96.5k, you’ll know to reconcile the difference right away. We also added the ability to post manual journal entries and even zero out the ledger if you need to reset after messy early usage. I’ve been there—when I started in 2023, I didn’t log everything perfectly, and the balance went negative in a way that obviously wasn’t true. Now you can correct course cleanly. In hard money lending, trust accounting isn’t optional; it’s central. These enhancements make it tight.

Future Features & Closing

That’s the batch—somewhere around 20 to 25 meaningful updates. We’re very close to announcing our Unified Inbox email feature and are just putting the final touches on it. It’s the kind of thing we want to get exactly right before we roll it out, and we’re almost there. When it lands, you’ll see it in the next update.

As always, the feedback we get from you—listeners and users—is paramount. There’s nothing like real-world input. These are truly my favorite episodes to do, because I get to look back and see the progress in black and white. It’s motivating, and the platform keeps getting more rock solid because of it. Thanks for listening, thanks for the ideas, and we’ll see you in the next one.

Contact us!

joinlendr.com

podcast@joinlendr.com

Instagram, LinkedIn, YouTube